Critics of Social Security have called it a Ponzi scheme. They argue that the program is functioning only because current workers pay into it, thus giving the government the money to pay the benefits for current retirees. They anticipate that there will not be enough funds to provide social security benefits to current workers when they retire.

Unraveling this issue and deciding for yourself requires understanding of what a typical Ponzi scheme is, how it operates and how Social Security is structured.

Comparison chart

How Ponzi schemes work

A Ponzi scheme is a fraudulent investment operation in which investors get returns not from any actual profit earned by the organization by investing the money, but from their own money or money paid by subsequent investors. The Ponzi scheme usually entices new investors by offering returns other investments cannot guarantee, such as abnormally high or unusually consistent returns. For the scheme to keep going and pay out the returns that are promised, an ever-increasing flow of money from new investors is required. The scheme is named after Charles Ponzi who became notorious for using the technique in early 1920.

Why Ponzi schemes are successful

One reason that the scheme initially works so well is that early investors, those who actually got paid the large returns, commonly reinvest their money in the scheme (it does, after all, pay out much better than any alternative investment). Thus, those running the scheme do not actually have to pay out very much (net); they simply have to send statements to investors showing them how much they earned by keeping the money, maintaining the deception that the scheme is a fund with high returns.

When an investor wants to withdraw, promoters try to dissuade them by offering them higher returns for different, longer-term investments. When that fails, withdrawals are processed promptly so investors believe that the fund/scheme is solvent.

How Social Security Works

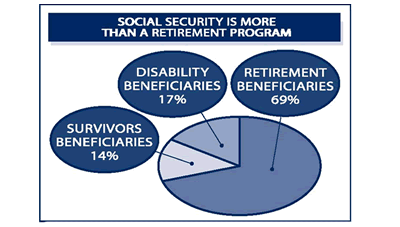

Social Security is a far-reaching system, offering many types of benefits. For this comparison we will focus on the retirement benefit. For a larger explanation, watch the video below.

Sources of Funds

The program is funded primarily through dedicated payroll taxes called FICA (Federal Insurance Contributions Act). Employers and employees pay this tax (the current rate is 6.2% each) in equal amounts and self-employed individuals pay both parts (12.4%). Another source of funds is the income taxes paid by current retirees. Social Security benefits are considered taxable income so for retirees with high benefit amounts, tax is due on their benefits. A third source of income is interest paid by the government on Treasury bonds held by the OASDI trust fund (that is the fund that manages the social security program).

Expenses

The Social Security program spends a little over half a cent in administrative expenses for every dollar managed by the fund. Most of the expenses, however, are in the form of retirement benefits and disability benefits.

Solvency

Technically, the program is solvent today because it takes in more money than it pays out. The OASDI trust fund has a large surplus that has been accumulated since the beginning of the program. Every year, excess funds are "invested" in government-backed securities -- special Treasury bonds that yield interest but can only be redeemed by Social Security's OASDI trust fund.

When the program began in 1935, there were far more people in the workforce compared to the retired population. However, the ratio of workers per beneficiary has been declining. From 5.1 in 1960, the ratio was down to 3.3 in 2005 and is expected to be 2.1 in 2031. As this ratio falls, it is expected that Social Security will no longer be able to generate surpluses every year.

Indeed, Social Security expenditures exceeded the program's non-interest income in 2010 for the first time since 1983. However, the deficit was less than the interest income for the fund, and therefore the fund continued to grow overall.

The 2023 Annual Report summary states this about the solvency of Social Security:

The Hospital Insurance (HI) Trust Fund will be able to pay 100 percent of total scheduled benefits until 2031, three years later than reported last year. At that point, the fund's reserves will become depleted and continuing program income will be sufficient to pay 89 percent of total scheduled benefits.

The Old-Age and Survivors Insurance (OASI) Trust Fund will be able to pay 100 percent of total scheduled benefits until 2033, one year earlier than reported last year. At that time, the fund's reserves will become depleted and continuing program income will be sufficient to pay 77 percent of scheduled benefits.

If the OASI Trust Fund and the DI Trust Fund projections are added together, the resulting projected fund (designated OASDI) would be able to pay 100 percent of total scheduled benefits until 2034, one year earlier than reported last year. At that time, the projected fund's reserves will become depleted and continuing total fund income will be sufficient to pay 80 percent of scheduled benefits. (The two funds could not actually be combined unless there were a change in the law, but the combined projection of the two funds is frequently used to indicate the overall status of the Social Security program.)

Differences and similarities between Social Security and a Ponzi scheme

The similarity between Social Security and a Ponzi scheme is that past "investors" (current retirees) are seen as being paid from funds collected from current "investors" (future retirees). The other similarity is that people are discouraged from withdrawal by promising higher returns if they withdraw later. It may be argued that a third similarity is that there is really no "account" for every individual with money in it. Social Security benefits are calculated using a complex formula and not based solely on the individual's contributions during their working years.

However, Social Security is different from a Ponzi scheme because:

- No outsize returns are promised by Social Security.

- Participation in Social Security is not voluntary.

- Ponzi schemes are insolvent; Social Security is not insolvent.

- Funds received into Social Security are invested in government-backed securities at a certain interest rate, thus generating returns. In a Ponzi scheme, there are no investments made.

- Ponzi schemes work only until people get wind of what is going on, at which point they inevitably collapse. Social Security's finances are plainly visible for all to see. Modest adjustments in tax rates, benefit formulas and the retirement age can ensure the program's viability for generations to come.[1]

- Ponzi schemes are a criminal enterprise; Social Security is not.

The counter-argument

Critics argue that even though the OASDI trust fund technically has assets, this is simply an accounting "trick". For the government to pay its debts to OASDI, it will have to raise revenue through more taxes. In essence, this means taking money from beneficiaries (and others) to pay them back. The Heritage Foundation states:

An employer pays taxes to the Treasury by periodically sending a check (or electronic transfer) that includes both income taxes and payroll taxes. There is also no indication of which individual employees' taxes are being paid or how much those employees earned.

On a regular basis, the Treasury estimates how much of its aggregate tax collections are due to Social Security taxes and credits the trust funds with that amount. No money actually changes hands: This is strictly an accounting transaction. These estimates are corrected after income tax returns show how much in payroll taxes was actually paid in a specific year. In addition, the Treasury credits the trust funds with interest paid on its balances and with the amount of income taxes that higher-income workers pay on their Social Security benefits.

To pay benefits, the Social Security Administration directs the Treasury to pay monthly benefits, and that amount is subtracted from the total in the trust funds. Any remainder is converted into special-issue Treasury bonds, which are really nothing more than IOUs. After the trust fund has been credited with the IOUs, Social Security's extra tax revenue is then spent by the Treasury just as any other taxes are spent. If the federal budget is running a surplus, that amount could be used to repay federal Debt owned by the public. Otherwise, it is spent on any other type of federal program, ranging from aircraft carriers to education research.

MLM

MLM  Bubble

Bubble  Real Trust Funds

Real Trust Funds

Comments: Ponzi Scheme vs Social Security